Articles and Information

Dear Clients, During this very unusual time, we know that you may have questions regarding the assistance options that are currently available to help with business expenses. We have listed some quick links below which provide valuable information and assistance with Coronavirus Relief Options. Here is a link to...

2019 Q4 Tax Calendar - Key Deadlines for Businesses and Other Employers Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2019. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact...

The Tax Implications of a Company Car The use of a company vehicle is a valuable fringe benefit for owners and employees of small businesses. This benefit results in tax deductions for the employer as well as tax breaks for the owners and employees using the cars. (And of course,...

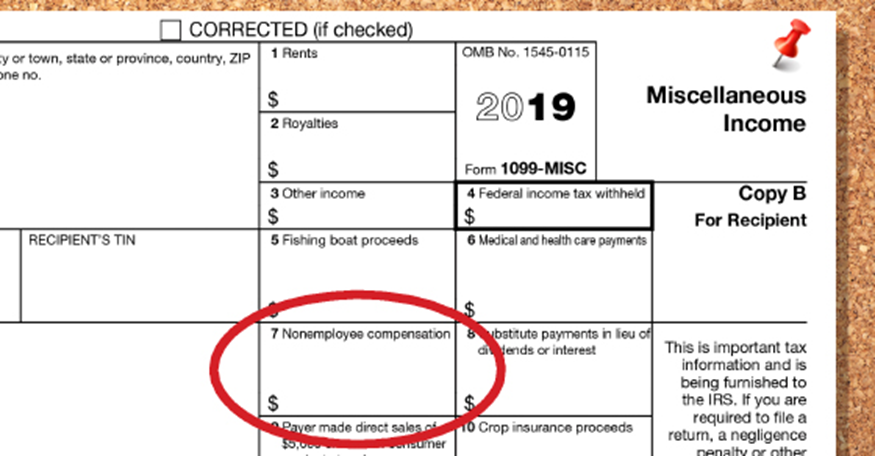

Small Businesses - Get Ready For Your 1099MISC Reporting Requirements A month after the new year begins, your business may be required to comply with rules to report amounts paid to independent contractors, vendors, and others. You may have to send 1099-MISC forms to those whom you pay nonemployee compensation,...

Take a Closer Look at Home Office Deductions Working from home has its perks. Not only can you skip the commute, but you also might be eligible to deduct home office expenses on your tax return. Deductions for these expenses can save you a bundle if you meet the tax...

Are Your Employees Ignoring Their 401Ks For many businesses, offering employees a 401(k) plan is no longer an option — it’s a competitive necessity. But employees often grow so accustomed to having a 401(k) that they don’t pay much attention to it. It’s in your best interest as a business...

2019 Q2 Tax Calendar Key Deadlines For Businesses And Other Employers Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2019. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you....

Financial Statements Tell The Story of Your Business - Inside and Out Ask many entrepreneurs and small business owners to show you their financial statements and they’ll likely open a laptop and show you their bookkeeping software. Although tracking financial transactions is critical, spreadsheets aren’t financial statements. In short, financial...

Looking For a Retirement Plan For Your Business - Here is One Simple Option Has your small business procrastinated in setting up a retirement plan? You might want to take a look at a SIMPLE IRA. SIMPLE stands for “savings incentive match plan for employees.” If you decide you’re interested...

Family Businesses Need Succession Plans Too Those who run family-owned businesses often underestimate the need for a succession plan. After all, they say, we’re a family business — there will always be a family member here to keep the company going and no one will stand in the way. Not...